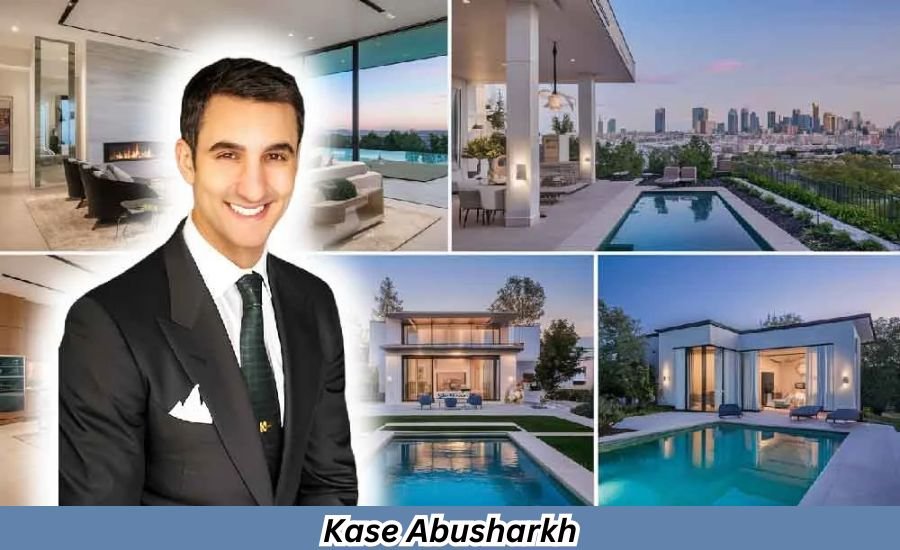

Kase Abusharkh has become one of the foremost experts on commercial real estate investments and strategic investments. As the founding principal of The Kase Group and a partner at Bear Equities, he has shaped the industry through his expertise in acquiring, financing, and developing high-value properties across the U.S. With leadership roles in firms like American Realty Capital, Kase Abusharkh has overseen billions of dollars in commercial projects, transforming retail and multi-tenant spaces nationwide. Learn more about influential leaders like Kase Abusharkh here at Wiki247.

Beyond his business success, Kase Abusharkh is dedicated to meaningful social contributions. Through scholarships for students affected by illness and funding for kidney transplant research with Stanford Medicine, he actively gives back, creating a lasting impact that goes far beyond his professional achievements.

Who is Kase Abusharkh?Exploring the Profession of a Real Estate Innovator

Kase Abusharkh is an extremely influential person within the world of real estate and is known for his unique method of real estate investment and development. Since establishing The Kase Group, he is changing the face of the industry of commercial real estate through strategic insight as well as a progressive approach. More than twenty years of professional experience, Kase has participated with billions of dollars in real estate transactions, and has gained the reputation of being an innovative well-qualified in her field.

Abusharkh started his job in the field of retail and multi-tenant areas, and eventually earned an award for his capacity to make strategic investments. Through collaborations with experts in the field and overseeing large-scale projects, he’s made significant contributions to the development of commercial real estate as well as investing strategies. In the present, The Kase Group continues to be an influential force shaping the market for real estate with creative projects and forward-thinking ways of investing.

Kase Abusharkh’s biography

| Biography | Details |

| Full Name | Kase Abusharkh |

| Educational Background | Bachelor’s Degree in Business & Economics from St. Mary’s College of California |

| – MBA from Brown University | |

| Key Professional Roles | – Partner at Bear Equities: A leader in diverse real estate investments |

| – The Kase Group was founded by the Kase Group: Real estate business that invests and develops | |

| Philanthropy | – The Kase, Jeannine, and Jacob Abusharkh Fund: Supporting students impacted by illness |

| – Focus on scholarships and research in kidney transplantation at Stanford Medicine | |

| Investment Portfolio | – Over 30 commercial properties acquired since 2020, valued at $125 million+ |

| – The real estate industry is investing in technology, and the food and beverages industries | |

| Investment Strategy | – Attention on sustainability over the long term and the creation of value |

| – Responsible investing prioritizing both financial returns and social impact | |

| Leadership Style | – Known for forward-thinking strategies and a focus on diversified investments |

| Unique Strengths | – Ability to identify profitable opportunities while maintaining a commitment to ethical practices |

| Community Impact | – Philanthropy and community involvement reflect a commitment to improving lives beyond business |

| Key Achievements | – Built a diverse portfolio across multiple industries, with an emphasis on commercial real estate |

| – Influences the industry of real estate and wider community through innovative strategies |

The Kase Group: Building a Real Estate Powerhouse

under the guidance of Kase Abusharkh as its CEO, the Kase Group has become a prominent company in the field of commercial real estate. It specializes in buying the development, management, and acquisition of property with high value that will yield steady returns over the course of time. Kase’s leadership has proven crucial in brokering thousands of lucrative real estate deals with a particular focus on multi-tenant and retail buildings.

The expansion of The Kase Group reflects Kase’s goals for the business. While the landscape of real estate changes The firm’s steady success can be traced to smart investment decisions, strategic alliances as well as a fresh method of development. Kase’s leadership has continued to warrant that the Kase Group remains a respected and trusted brand for commercial real property.

From Broker to Chief Investment Officer: Kase Abusharkh’s Career Journey

Kase Abusharkh’s well-qualified path highlights his extraordinary transition from broker to well-known CIO. (CIO). At the start of the course of his job, Kase established himself as an expert broker with keen business sense and strategic planning. His job course led to the position of the CIO for American Realty Capital – Retail Core topics of America.

In his role as CIO, Kase played a crucial role in securing over $1 billion of equity as well as buying thousands of square feet of retail properties. The knowledge he gained from both investments and brokerage industries gave Kase a distinct advantage that allowed him to negotiate the maze of investing in real estate and bring off success. His rise as a broker and CIO is a testament to his flexibility and experience, which have contributed to his growth in the field of real estate.

Kase Abusharkh’s Leadership at American Realty Capital

In his time in American Realty Capital – Retail Core topics of America, Kase Abusharkh played a key role in the success and growth of the firm. Kase played an integral role in expanding the company’s retail properties portfolio, helping to secure important assets as well as raising substantial capital for the firm’s continued success.

Kase’s leadership, strategic advice and guidance led American Realty Capital to grow into a significant company in the commercial real estate industry. The insight of Kase and his ability to take bold decisions contributed to the establishment of the company as an important market player.

The merger that created the REIT that is worth $4 billion Kase Abusharkh’s Changed Role in the Game

The turning point for Kase Abusharkh’s job was when he assisted create a merger that resulted in an estimated four billion Real Estate Investment Trust (REIT). What resulted from this merger was to create American Finance Trust Inc. American Finance Trust Inc.. A diversified and strong REIT.

Kase’s ability to navigate complicated mergers and taking important strategic choices was crucial to developing this top REIT in the industry. Kase’s ability to spot the opportunities, and his leadership during finalizing the merger turned the organization into one the most powerful and successful REITs in America. The merger was an important turning point for Kase’s job and in the wider real estate sector.

| Net Worth | Details |

| Name | Kase Abusharkh |

| Profession | [Profession, e.g., Entrepreneur, Investor, etc.] |

| Estimated Net Worth | [Net Worth Value, e.g., $X Million] |

| Source of Wealth | [Primary source of income, e.g., Investments, Business Ventures] |

| Country of Origin | [Country Name] |

| Known For | [What they are most known for, e.g., Tech Startups, Investments] |

| Year of Net Worth Estimation | [Year the net worth was estimated, if available] |

| Public Recognition | [Mention if the individual has gained public recognition or awards] |

Kase Abusharkh’s Philanthropic Efforts: Giving Back to the Community

Beyond his professional accomplishments, Kase Abusharkh is also dedicated to philanthropy. He established The Kase, Jeannine, and Jacob Abusharkh Fund, which provides scholarships to students impacted by illness and supports research in kidney transplantation at Stanford Medicine.

Here are the philanthropic efforts of Kase Abusharkh:

- Establishment of The Kase, Jeannine, and Jacob Abusharkh Fund

This fund is dedicated to supporting students impacted by illness. - Providing Scholarships

The fund offers scholarships to students who have been affected by illness. - Supporting Kidney Transplantation Research

The fund supports medical research in kidney transplantation at Stanford Medicine. - Commitment to Education and Healthcare

Kase’s focus on education and healthcare reflects his dedication to improving lives. - Support for Youth Education

Kase places a special emphasis on providing support to youth education.

You May Also Like; Pomezenski

The Kase, Jeannine, and Jacob Abusharkh Fund: A Commitment to Education and Medical Research

The Kase, Jeannine, and Jacob Abusharkh Fund is an essential component of Kase’s philanthropic mission.The funds are dedicated to helping students with disease and to advance research into kidney transplants. Through scholarships and contributions crucial medical research Kase helps improve the lives of people who are affected by illness as well as supporting efforts to discover ways to treat kidney diseases.

The effect of Kase’s fund goes far beyond real estate. It demonstrates Kase’s vision of creating positive changes within healthcare and education.

Board Membership and Awards: Kase Abusharkh’s Contributions Beyond Business

Kase Abusharkh’s contribution to his community extends far beyond the scope of his business. Kase is on the Board of Regents of Sacred Heart Cathedral Preparatory and has been given numerous awards in recognition of his work in the community. His dedication to giving back is apparent by his continued support for organisations like Hearts of Gold, which helps homeless mothers and children.

His leadership positions and ongoing charitable efforts Kase continues to be an inspiration in proving that the success of business is complemented by significant social contributions.

Bear Equities: Expanding the Investment Portfolio

Kase’s Role at Bear Equities

Kase is a partner at Bear Equities, helping diversify its investment portfolio.

Change From Single-Family Office to Investment Firm

Bear Equities has grown from an office with a single family to an investment firm with many facets.

Diversified Investment Portfolio

Bear Equities’ portfolio spans technology, real estate, and the food and drink sector.

Success with Commercial Real Property Acquisitions

From 2020 onwards, Bear Equities has acquired thirty commercial properties that are valued in excess of $125 million.

Kase’s Leadership and Investment Strategies

Kase’s visionary leadership and innovative investment strategies have been the driving force behind Bear Equities’ success.

The structure allows you to break down the most important points in each heading while keeping a clear structure.

Kase Abusharkh’s Investment Philosophy: A Focus on Long-Term Growth

What separates Kase Abusharkh out from other real property investors is his approach to investing. Instead of focusing on quick returns, Kase prioritizes sustainable growth and the creation of value. This has enabled him to develop a wide range of investments and properties that were intended to give the long-term benefits.

Kase’s decision-making ability, paired with his capacity to build solid partnerships has placed him as a leading figure in the real estate industry for commercial purposes and is influencing the future of real estate investment and development.

Educational Background: The Foundation of Kase Abusharkh’s Success

Kase Abusharkh’s education background was a major factor in the direction of his successful job. He earned both his Bachelors in Business and Economics at St Mary’s College of California as well as an MBA degree from Brown University. His academic successes have given him the understanding and talent needed to handle the complex world of commercial real property.

Here are the key foundations:

- Bachelor of Business and Economics.

Kase is a graduate with a major in Business as well as Economics at St. Mary’s College of California and provides a solid base in the business fundamentals. - MBA program from Brown University

He continued his studies with an MBA at Brown University, enhancing his management and decision-making abilities. - Knowledge and Skills for Real Estate

The academic successes of his professors provided him with the required understanding and talent to understand the intricacies of commercial real property. - Informed Choice-Making in Real Estate Investment

Education has provided him with the skills to make informed decisions about the field of real estate and management.

Kase Abusharkh’s Dedication to Youth through Scholarships

Kase Abusharkh’s work in philanthropy focuses on assisting young people who’ve suffered from disease. Through his The Kase, Jeannine, and Jacob Abusharkh Fund, he offers the opportunity to assist children with illness access further educational opportunities. The fund ensures that those facing significant obstacles receive the education needed to be successful in life.

Kase’s commitment to education for young people embodies his goal to have an effectful influence on those around him.

Why Kase Abusharkh Stands Out in Real Estate Investment

Kase Abusharkh’s standing as a renowned real estate investor rests by his distinctive approach to investing. With a focus on sustainability over time and value creation Kase is now an expert in his field. The ability to spot lucrative opportunities, coupled with his dedication to an ethical investment has helped made him stand out within the highly competitive field of commercial real property.

His leadership of The Kase Group, Bear Equities as well as his charitable endeavors, Kase Abusharkh continues to create lasting impressions in the industry of real estate as well as the wider society.

- Unique Approach to Investment

Kase stands out for his focus on long-term sustainability and value creation, rather than just short-term gains. - Ability to Identify Profitable Opportunities

His keen ability to identify profitable opportunities has allowed him to make successful investments that yield strong returns. - Commitment to Responsible Investment

Kase is known for his commitment to responsible investment practices, ensuring that his decisions benefit both his portfolio and the wider community. - Leadership in The Kase Group and Bear Equities

Kase has established himself as one of the foremost experts on real estate investment through his leadership of The Kase Group and Bear Equities. - Philanthropic Endeavors

Philanthropic endeavors that contribute to education and healthcare further demonstrate his singular approach, showing an equilibrium between business success and social responsibility.

Conclusion

In the end, Kase Abusharkh is a genuine leader in the realm of real property. Kase Abusharkh has established successful companies such as The Kase Group and Bear Equities through thinking about the long term and making wise investments. His dedication, innovative thinking, and his leadership talent have been instrumental in changing the face of the field of commercial real estate. Kase’s tale shows that if you have the right attitude and determination, you can be able to attain incredible things in business.

However, Kase isn’t just focused on business. He also takes great pride in giving back to the community. Through his work with charities as well as his Abusharkh Fund, he helps students as well as funds medical research. The outcome of his efforts prove the importance of earning money, but in making the world an improved place. Kase’s story shows us that the best your success can be derived by helping people and following your interests.

Read Next; Lows Adventure 3

FAQs

Q: Who is Kase Abusharkh?

A: Kase Abusharkh is an eminent real estate investor as well as the co-founder of the Kase Group. His name is associated with his innovative method of commercial real estate, as well as his expertise in investing successfully.

Q: What is The Kase Group?

A: Kase Group Kase Group is a commercial real estate business established by Kase Abusharkh. It is a specialist in the acquisition the development, management, and acquisition of the most valuable properties. It focuses primarily on multi-tenant properties.

Q: What is Bear Equities?

A: Bear Equities is an investment firm where Kase Abusharkh is a partner. The firm invests in various sectors, including real estate, technology, and food & beverage.

Q: How has Kase Abusharkh contributed to philanthropy?

A: Kase Abusharkh is deeply involved in philanthropy. He founded The Kase, Jeannine, and Jacob Abusharkh Fund to provide scholarships for students affected by illness and support kidney transplant research at Stanford Medicine.

Q: What is the Kase, Jeannine, and Jacob Abusharkh Endowment?

A: The endowment is a charitable fund created by Kase Abusharkh to support students affected by illness and fund kidney transplant research. It offers scholarships and helps advance critical medical research.

Q: What was Kase Abusharkh’s role at American Realty Capital?

A: Kase Abusharkh served as the Chief Investment Officer (CIO) at American Realty Capital – Retail Centers of America, where he helped raise significant capital and acquire valuable retail properties.

Q: How did Kase Abusharkh help create a $4 billion REIT?

A: Kase Abusharkh was a major contribution to the merger which was the catalyst for the establishment of American Finance Trust Inc. which is a $4 billion Real Estate Investment Trust (REIT) in charge of important strategic decisions as well as complicated mergers.

Q: What is Kase Abusharkh’s approach to real estate investment?

A: Kase Abusharkh’s investment strategy focuses on long-term growth, smart partnerships, and sustainable development, setting him apart from others in the industry.

Q: Where did Kase Abusharkh study?

A: Kase Abusharkh earned a Bachelor’s degree in Business and Economics from St. Mary’s College of California and an MBA from Brown University.

Q: What causes does Kase Abusharkh support through his philanthropy?

A: Kase supports education for students affected by illness and funds kidney transplant research through his philanthropic efforts, particularly through his family’s endowment fund.